During this pandemic, service businesses are needing cash flow more than ever and communication is the easiest place for you to slip up. It seems like an obvious and easy area to stay on top of as a business owner, but it would shock you to know how many businesses don’t do it well enough. Let’s dive into how you can use strong communication to your advantage and stay afloat.

It helps to start by outlining the principles that underpin communication for trades businesses:

The reason you have a business is because there are people out there that have problems that you know how to fix. In exchange for your solutions those people need to give you money, which is the basic underlying principle of any marketplace.

This means that it’s critically important that:

Some of you may already be familiar with the time cost quality triangle in construction. As the old adage goes, you may have any two but rarely all three. As tradespeople, we need to deliver a managed outcome or solution that is balance of these three things. So how do you do that?

The problem is that customers always want the solution delivered at the highest quality as quickly as possible at the lowest cost. But because this is unrealistic, there has to be compromises and this needs to be communicated as a solution (e.g. what the customer wants will cost more but can be finished in the desired timeframe and level of quality). The agreed-upon compromise then needs to be communicated to your team so that everyone clearly understands what the goal is. It’s this communication back and forth with the customer and finally with your team that results in customer satisfaction.

If you aren’t familiar with the Pareto principle, it basically states that 80% of effects come from 20% of causes. As any experienced business owner will know, this applies to customers:

80% of customer problems tend to come from 20% of your customers, and 80% of revenue comes from 20% of your customers.

So how do you avoid bad customers and retain good customers? In my experience, if you’re quoting a job and you’re already getting a sense that the customer could be difficult and disrespectful, it doesn’t bode well. If you haven’t done the work and it’s already difficult, it’s unlikely that doing the work and getting paid will be any easier, and it’s best to recommend another provider for them.

Most of you will be familiar with the saying ‘the customer is always right’. I prefer an adapted version of this which is: ‘the customer always deserves your respect’. That’s because if you always respect your customers, it’s much more likely that you’ll get off on the right foot with (and retain) the good customers, and they’ll often recommend you to their friends who likely conduct themselves in the same way.

First, you must satisfy the internal customer (your staff) before you can satisfy the external customer, because if your staff isn’t happy it becomes very difficult to provide quality outcomes for the customer. So how do you do this?

A good place to start is culture: the way that you communicate with your staff defines your company culture. This is where your leadership needs to shine, because the way you behave as the leader will always set the example that your staff will follow.

But you have to give something to your staff to get productivity out of them, and you need to communicate that you’ll do this with your staff so that they clearly understand the expectations. For example: “I won’t yell at you and you can rely on me to pay you. In exchange for this I ask that you are honest with me and you work hard to deliver outcomes for the customer.” It seems simple, but this clarity leaves little room for misunderstanding and clearly defines what is and isn’t ok.

Slow-paying and non-paying customers are the banes of any business’s cash flow, but situations, where there are payment disputes, are actually usually avoidable. Below are some easy tips to keep in mind.

It seems like an obvious observation, but if you call the customer when there’s a variation on a job, let them know it’ll be more expensive than initially quoted and then ask them how they’d like to proceed – they’re far more likely to pay you than if you leave them with an invoice at the end that’s twice the cost of what you had discussed.

If a customer is unhappy with the outcome on a job, then you can be sure you’ll have trouble getting them to pay a dime. The good news is that it’s easy to clear up these disputes by calling them immediately after the job is completed and making sure that they’re happy that the job was done to the standard they expected. If they aren’t happy, this is the time to sort that out. If there are any issues and you don’t check in, you won’t find out about it until 4 weeks later when they haven’t paid and you call to find out that it was a simple misunderstanding.

Once you’ve done this, you can start setting expectations for when you can expect payment. This doesn’t need to be confrontational, it can just be a casual conversation and is a very reasonable thing for you to ask. A soft way to approach this is just to say: “When can we budget on payment?” This sets an expectation between yourself and the customer, and defines their commitment to you in exchange for what you’re doing for them.

If you’re looking for quick wins to get your cash flow going, the people you should be getting in touch with now are:

Cash flow is more important now than ever and as the business owner or manager, you need to navigate how you can keep your business in good health. Customers usually have leverage as they can withhold cash until they’re happy, so it’s your responsibility to control that exchange by communicating as clearly as possible internally and externally. If you want to learn more about cash flow and how to forecast yours, check out this business coaching session for a step-by-step tutorial on cash flow forecasting.

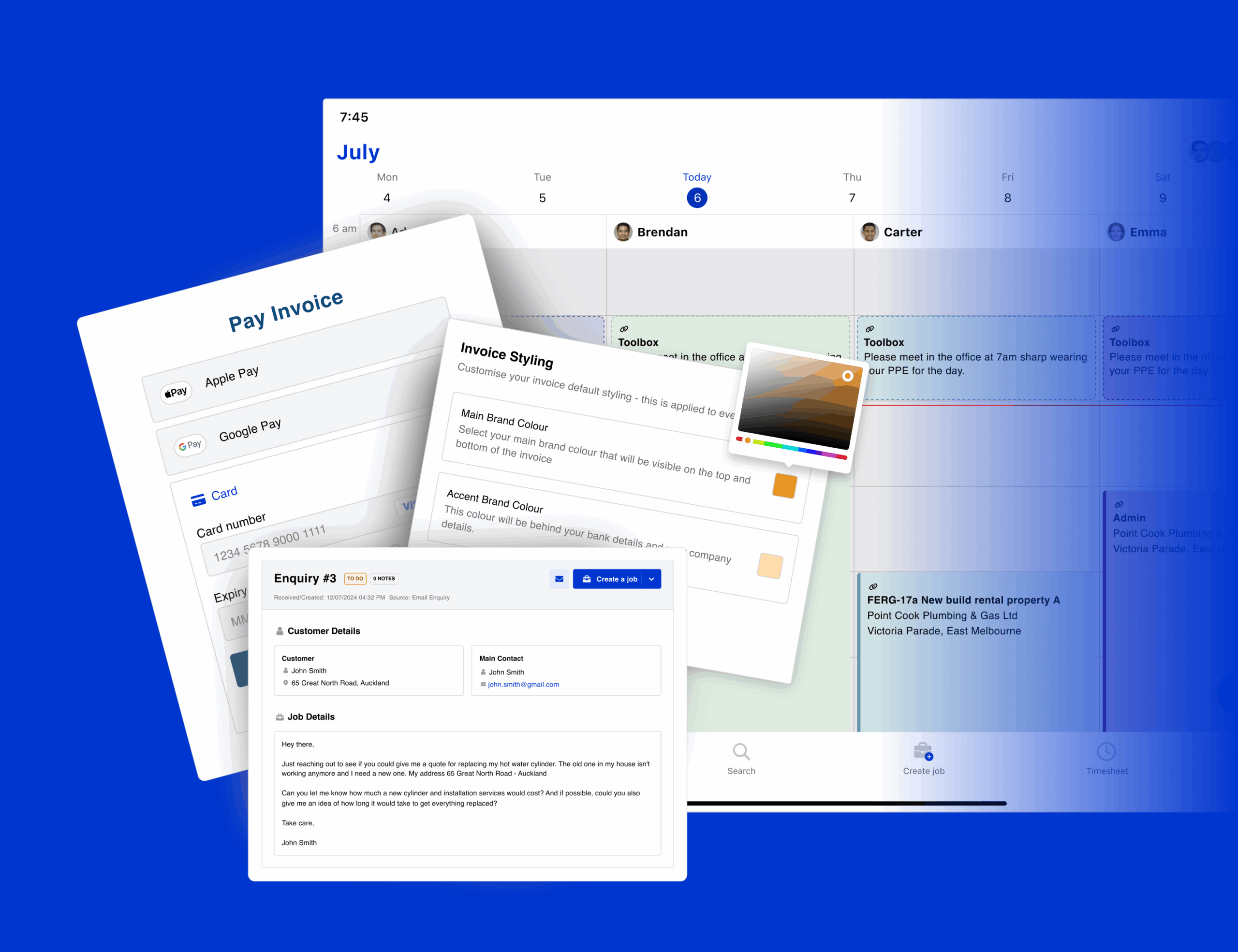

Stop drowning in admin & paperwork. Start focusing on the jobs that make you money.

Our 20,000+ trades businesses have slashed their admin, are getting paid faster, and are finally enjoying their weekends again.

Chat with a Fergus expert to see how we can cut your admin time, keep your jobs on track, and get you paid faster.