TRUSTED BY 20,000+ TRADIES

Give your customers the convenience of debit card, credit card & on-site payments. Get paid on time, every time. Start a free trial of Fergus to get access to Fergus Pay.

In Australia, over 75% of purchases are paid by card. Keep your business up to speed and competitive with Fergus Pay.

Make it quick and easy for your customers to pay with credit card and on-site. Get paid on time and take charge of your cash flow so you’re never caught out.

Provide customers more convenience and flexibility with different payment options.

Get paid on time and eliminate the stress that comes with cash flow issues and chasing invoices.

Take care of payments instantly on-site via the Fergus mobile app. Available for Android and iOS.

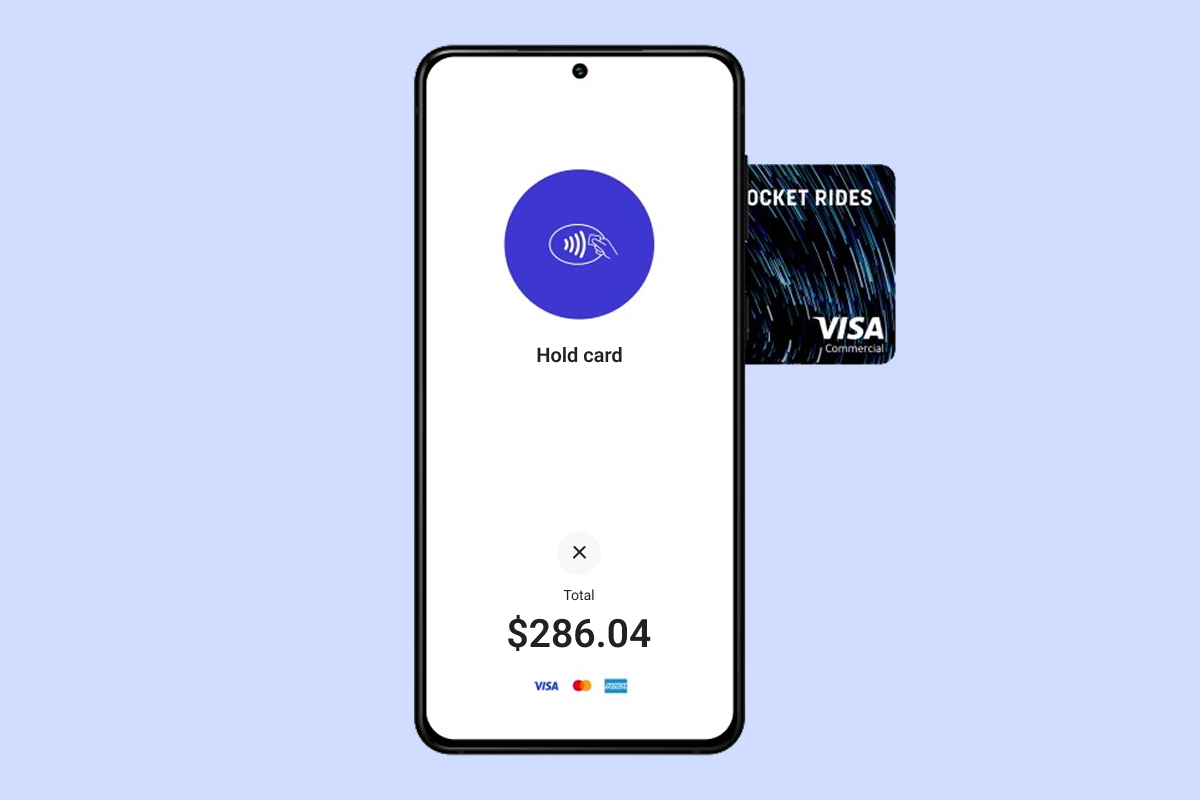

NEW

TAP TO PAY

Take contactless payments on site. It's fast and simple.

Close out jobs on the spot, keep your cash flow moving, and cut the admin.

For your customers, it’s just as easy: tap a card or use a mobile wallet, and the job’s sorted then and there.

All you need is your mobile device, the Fergus Go app and a Fergus Pay account.

Knock out invoicing and payments right on-site so you don’t have to worry about it later. Convenient and fast.

With Scan to Pay, your customers can quickly scan a QR code and securely pay with a saved credit card using their own iPhone or Android device.

Make it easy for your customers to pay you on-site or as soon as they get the invoice.

It's a win-win for everyone. You get invoices settled faster, while customers gets the convenience of credit card payments.

Plus, getting paid on time ensures you always have cash on hand to take care of business - pay yourself, your team, and your suppliers reliably on time, every time.

Find out why 20,000 tradies trust Fergus. Start your 14 day free trial.

There are no setup or monthly costs when using Fergus Pay. However, there is a Stripe fee charged by Fergus once your customer makes payment. The fees vary per region an can be found here

Our 20,000+ trades businesses have slashed their admin, are getting paid faster, and are finally enjoying their weekends again.