Come on down, welcome to The Price is Right. Remember this classic television game show where contestants jumped with excitement on getting the call-up? You’re probably not feeling as enthusiastic and upbeat about nailing your trade business’s pricing structure.

Are you ready to play a different game?

Before you spin the wheel, it’s important to understand what hourly rate you should be charging to break even, plus make a profit. For the purposes of this blog, we’ll focus on 4 factors to consider when developing the pricing structure for your business.

Do you have a firm grasp on which existing products and services are profitable in your business? By carefully analysing what is already working within your business, you can hone in on that style of work.

In our plumbing business, DR. DRiP Plumbing, we found the most lucrative work has proven to be blocked drains and hot water units. We established both of these services have a decent profit margin.

What is this in your business?

Get started by reviewing your financial data. This important and insightful information will assist your decision-making in relation to targeting more work on a high-profit margin.

Review your rates, per market segment.

It can be helpful to have a different pricing scale for different market segments. For example, residential customers may make up the first level, stepping up to loyal strata, and commercial and real estate agents.

You’ll get a clear idea of which market segment is a winner for you through your job management software. With the facts in hand, you are now empowered to pinpoint work with a higher average dollar sale.

Breaking it down even further, there are customers and companies within those market segments. Your pricing structure could be tweaked for each of these businesses, based on average dollar sales.

To work out the average dollar sale for a single real estate agent, for example, print a record that provides all jobs completed by that single agent in a particular defined timeframe. Still with me?

Divide the dollar value by the number of jobs completed over the same period. If this average dollar sale is below the rate you must charge to break even and make some profit, you’ve got to fix this.

How does your pricing compare with your competitors? While products and services are not always created equal, it’s beneficial to have a solid understanding of what’s being charged in the same market.

You could undertake a formal competitor analysis to determine whether your pricing structure is affordable, expensive or middle of the road. Or, you could ask your loyal customers directly about what they think.

Either way, it’s up to you to get a handle on which customer(s) you’re targeting. That way, you can match up your service offering and pricing structure accordingly – and aim to retain them!

We know customer retention provides approximately three times the average dollar sale, once trust and rapport has been developed! Feeling more excited about nailing your pricing structure now?

Getting your quotes right is also a major part of winning this work. Download our 5 cheat sheets to generate more conversions.

This guest blog was contributed by Andy Smith, Co-Founder, Lifestyle Tradie.

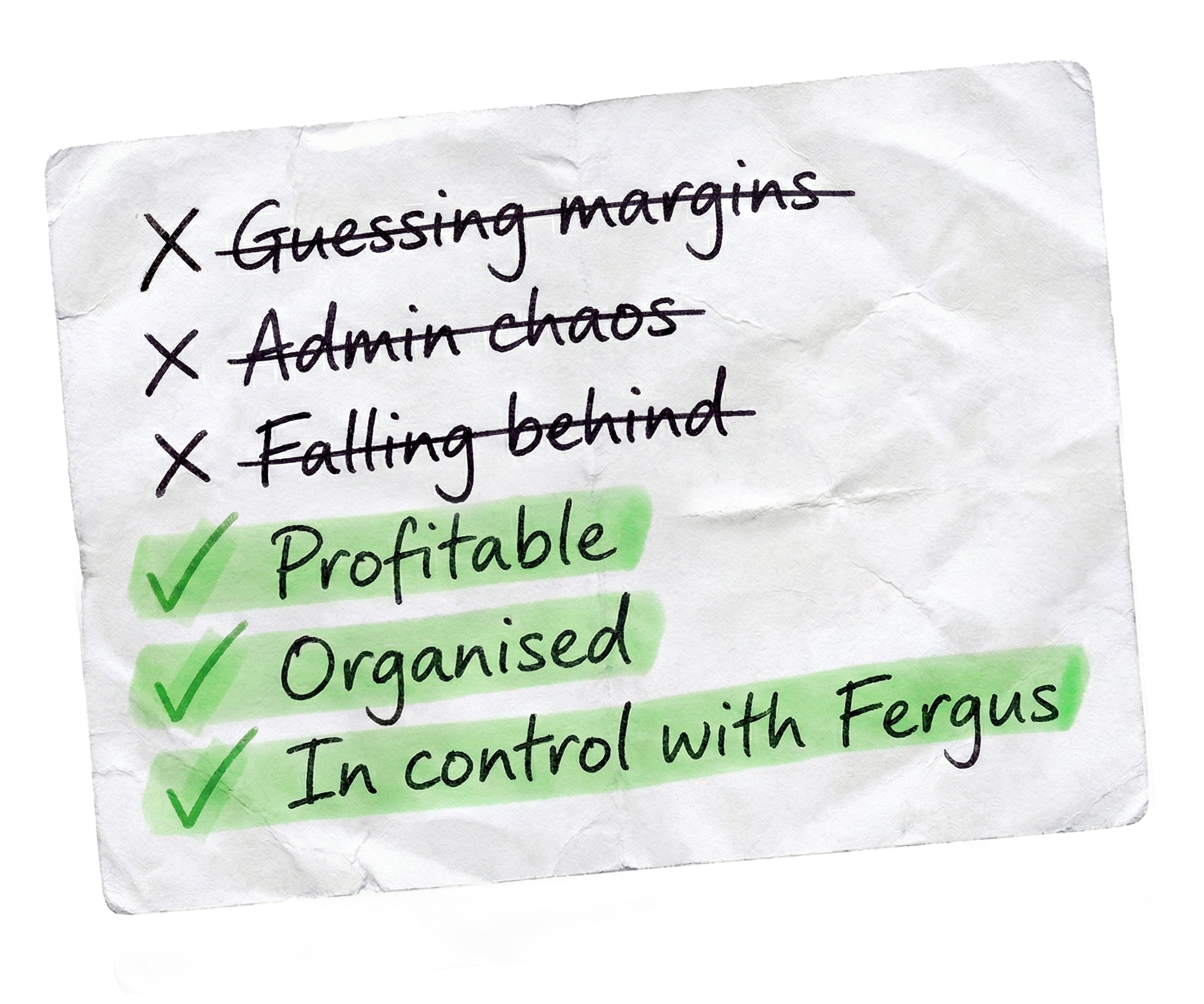

Stop drowning in admin & paperwork. Start focusing on the jobs that make you money.

Our 20,000+ trades businesses have slashed their admin, are getting paid faster, and are finally enjoying their weekends again.