Credit card payments are one of the most effective cash flows tools a tradie has in their business toolkit. Instant payments ensure that payments are on time – every time – and customers are happy with the flexible payment options. Fergus Pay powered by Stripe, is now available in Fergus – collect credit card payments, get paid faster, and speed up your cash flow.

The best part – they’re as easy as pie to set up thanks to Fergus Pay. You get all the cash flow benefits of credit card payments without the up-front costs and red tape to sort through.

Here are our tips on how Fergus Pay can help your business:

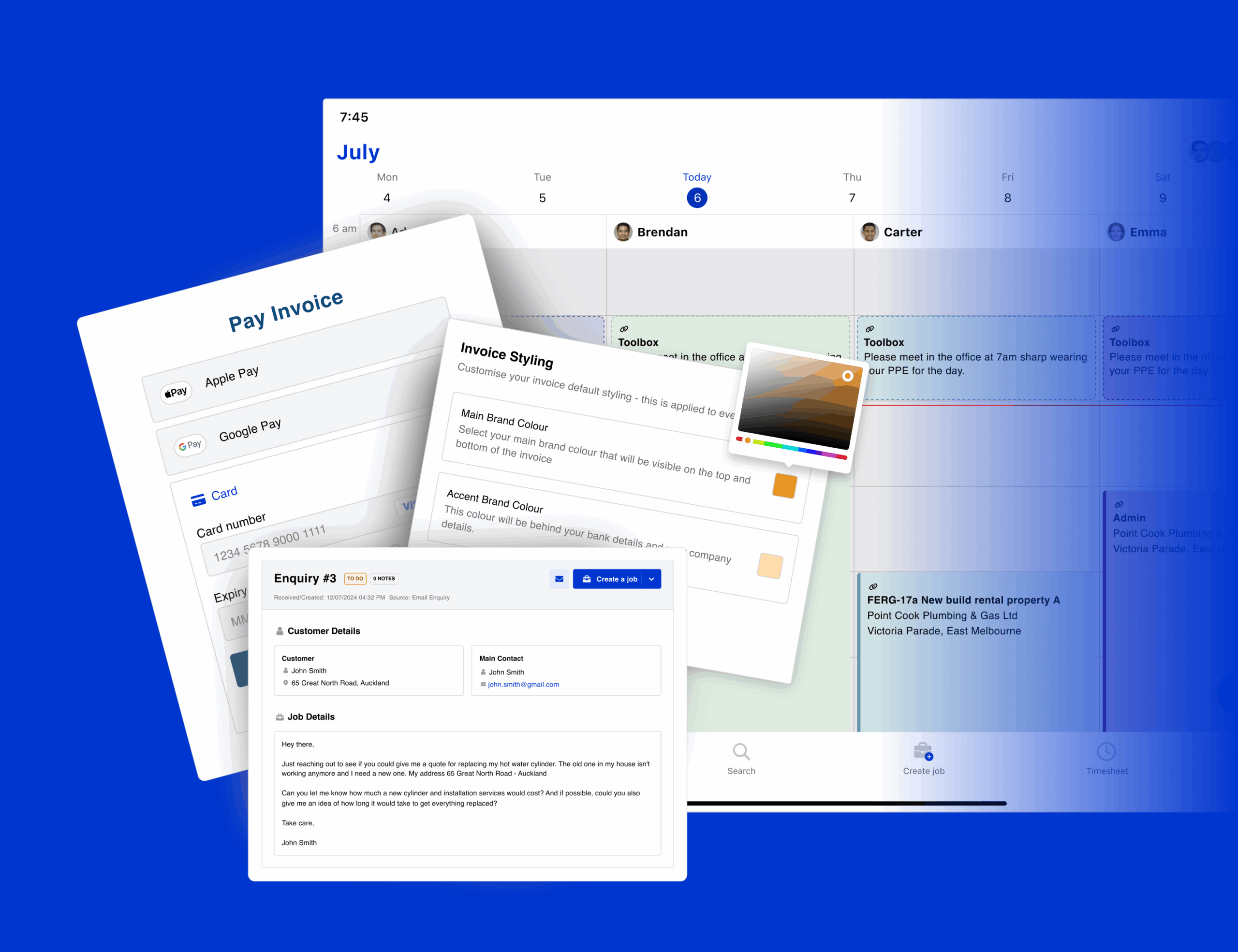

Healthy cash flow begins and ends with getting paid on time, or even better, the same day the job is done. Fergus Pay allows customers to pay you with a credit card right after they receive your invoice through email or SMS.

“The money comes through straight away. It’s all taken care of.” Andrew, Watersmith Plumbing

Dipping in and out of overdraft when you run into cash flow issues can be costly for any small business. Credit card payments help you get paid faster and mean you’re less likely to have to resort to an overdraft at the end of the month when it comes time to pay all your bills.

Setting up a credit card processing service for your business can be costly, time-consuming and filled with red tape. There are credit checks to go through, paperwork and ongoing monthly service fees.

With Fergus Pay, we’ve taken care of all the necessary paperwork. You don’t need to pay any up-front costs or sign any contracts – it’s ready to go whenever you are.

4. WIN NEW CUSTOMERS

Advertising that you take credit card payments could be the difference between getting asked to quote for a job or not.

Why? Potential customers may not only prefer to pay by credit card, they may need to. Ultimately, if your potential customer has an urgent job but doesn’t have funds immediately available, they would prefer a tradesperson who accepts credit cards over one who doesn’t.

Accepting credit card payments increases the credibility of your business and elevates your professional image – crucial for any small business, especially if you’re just starting out.

5. KEEP CUSTOMERS HAPPY

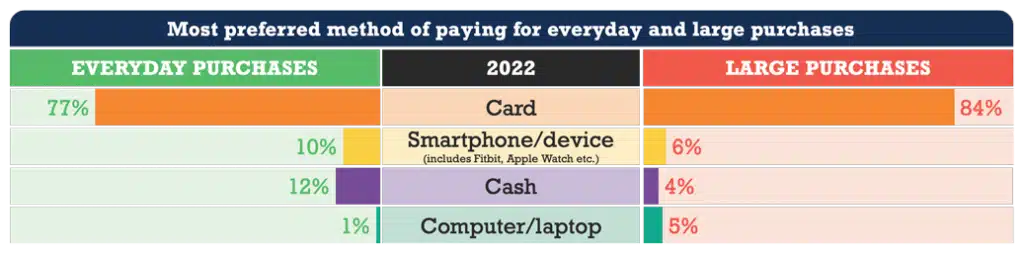

In Australia, the UK and NZ, card purchases make up a majority of all consumer purchases. As well as being convenient, most people now prefer to pay by plastic because they can earn loyalty points and get cash back. Consumers have come to expect to be able to pay instantly, and to be able tick off the task off their to do list. Offering instant and convenient payment options helps you to meet customer expectations.

6. FAST FUNDS AND FEWER LATE PAYMENTS

The best part of having an easy, simple way for your customers to pay you – you’re going to get paid faster and you’re less likely to be chasing overdue invoices. Easily keep track of your incoming payments with the dedicated Fergus Pay dashboard, and save yourself the extra admin and the sleepless nights of wondering where the money is.

Safeguard your hard earned cash with security checks, guaranteeing the authenticity of each transaction for every card transaction. If there’s any suspicious activity, Fergus Pay takes immediate action by either requesting additional verification from the customer or blocking the transaction altogether. You can relax knowing that you get fraud protection and extra protection for every payment.

Did you know that payments can be improved by 7-9% by the use of SMS reminders? That’s because 95% of SMS messages are opened within minutes of being received?

Fergus job management software allows you to send payment reminders by SMS, not just by email. Customers can view the invoice via a link in the SMS and click through to the payment portal. Payment can be made in just a few steps, no matter where they are when they receive your reminder.

9. STREAMLINED PAYMENT RECONCILIATION

Use the Fergus Pay dashboard to view the status of each invoice to see what is “processed” and “pending”. The Payouts tab makes reconciliation easy with a detailed breakdown of payouts to your bank account, and which invoices are relate to each payout.

Fergus job management software is designed to help streamline the way you work, saving you time and making you more money. Try Fergus for free for 14 days to find out how it can transform the way you work.

Stop drowning in admin & paperwork. Start focusing on the jobs that make you money.

Our 20,000+ trades businesses have slashed their admin, are getting paid faster, and are finally enjoying their weekends again.

Chat with a Fergus expert to see how we can cut your admin time, keep your jobs on track, and get you paid faster.