For small-mid size electrical businesses, invoicing can sometimes feel like an afterthought. But in reality, getting your invoicing process right is one of the most crucial aspects of running a successful business. Clear, timely, and professional invoicing doesn’t just help you get paid faster—it also creates a polished image for your company and keeps your cash flow steady.

In this guide, we’ll cover best practices for managing your invoices, ensuring payments are collected, and keeping your business looking professional. Plus, we’ll show you how Fergus can make invoicing a breeze and help you take control of your payments.

If you’re waiting days—or even weeks—after a job is complete to send an invoice, you’re already losing time and momentum. The sooner you send your invoice, the more likely your customer is to pay promptly.

But let’s be honest, paperwork isn’t anyone’s favourite job, and it’s easy to put it off. That’s where Fergus steps in. With Fergus, you can use the Quick Invoice feature to turn a quote into an invoice in seconds. Did you quote a job last week and complete it today? Boom—click a button, and you’ve got a professional invoice ready to go.

Pro Tip: Make it a habit to invoice on the same day the job is completed. It keeps your business top of mind for the customer and reduces the chance of delays.

First impressions count, even with invoices. A messy or confusing invoice can make your business look unprofessional and give customers an excuse to delay payment.

Your invoice should include:

If you’re using Fergus, all of this is a given. Fergus generates clean, professional invoices every time, ensuring your customers know exactly who they’re paying and what for.

Keeping track of who’s paid and who hasn’t can get tricky when you’ve got multiple jobs on the go. You don’t want to be left chasing overdue invoices weeks later, only to realise you forgot to send a reminder.

With Fergus, you’ve got everything in one place. The Fergus Dashboard gives you a bird’s-eye view of your invoicing:

No more spreadsheets or sticky notes—just a clear system that makes chasing payments easier.

One of the fastest ways to get paid is to make it as easy as possible for your customers. Gone are the days when a bank transfer was the only option. Now, customers expect the convenience of paying by card or even through a payment link.

That’s where Fergus Pay comes in. Fergus Pay allows you to accept card payments directly from your invoices. Your customers can simply click a link and pay online—no faffing around with bank details. Plus, faster payments mean you can spend less time chasing invoices and more time running your business.

Ever had a customer assume they can pay whenever they feel like it? It’s frustrating, but it’s often because payment terms weren’t made clear.

Your invoice should state exactly when payment is due—7, 14, or 30 days—and whether late payments will incur fees. Setting expectations upfront reduces misunderstandings and gives you more leverage if you need to follow up.

Pro Tip: Shorter payment terms (e.g., 7 days) often result in faster payments. Customers tend to prioritise invoices with tighter deadlines.

Sometimes, even the best customers forget to pay. A polite nudge can go a long way in speeding up the process.

With Fergus, you can automate payment reminders, so you don’t have to spend time crafting emails or making awkward phone calls. The system sends friendly reminders at the right intervals, keeping you professional while prompting payment.

Example Reminder:

“Hi [Customer’s Name], just a quick reminder that Invoice #12345 is due on [Due Date]. Please let us know if you have any questions. Thank you!”

Mistakes on invoices can delay payment and make your business look unprofessional. Watch out for these common errors:

Fergus helps eliminate these issues by standardising your invoices and ensuring all the key details are included every time.

Tax season can be a nightmare if your invoices are scattered across emails, notepads, and your phone’s camera roll. By keeping everything centralised and organised, you’ll save yourself a lot of stress (and probably some money on accounting fees).

Fergus automatically logs all your invoices, so you can easily access them when needed. Plus, you can export your data to share with your accountant or for your own records.

Your invoices are part of your branding. A polished invoice with your logo, colours, and contact details reinforces the professionalism of your business.

Fergus makes it easy to customise your invoices with your brand logo, helping you stand out and leave a lasting impression on your customers. It’s a small detail, but one that builds trust and loyalty over time.

Running an electrical business is already demanding, so why add more admin work to your plate? Using software like Fergus simplifies the invoicing process, giving you more time to focus on your actual work.

Here’s how Fergus can transform your invoicing process:

Speed: Create and send invoices in seconds.

Automation: Set up reminders and follow-ups automatically.

Visibility: Keep track of all your invoices and payments in one place.

Convenience: Offer card payments through Fergus Pay.

In short, Fergus takes the stress out of invoicing, so you can get paid faster and focus on growing your business.

Invoicing doesn’t have to be a hassle. By adopting the right practices and leveraging tools like Fergus, you can make invoicing seamless, professional, and effective.

With features like Quick Invoice, the Fergus Dashboard, and Fergus Pay, you’ll have everything you need to stay on top of your invoicing and ensure payments come in on time.

Start taking charge of your invoicing today, and watch your cash flow – and your reputation – improve.

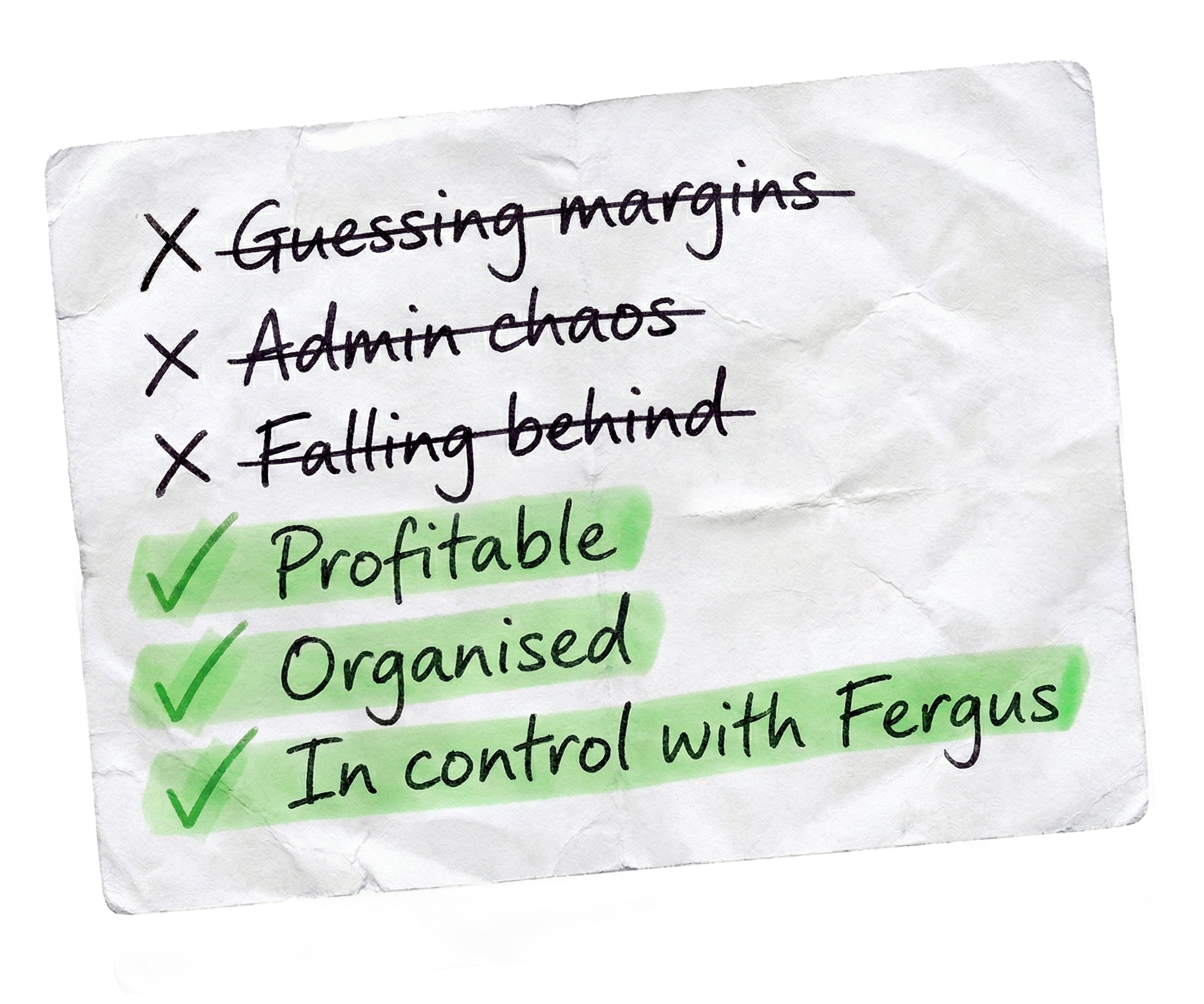

Stop drowning in admin & paperwork. Start focusing on the jobs that make you money.

Our 20,000+ trades businesses have slashed their admin, are getting paid faster, and are finally enjoying their weekends again.