When work is a bit slow and you’ve got a few slow-paying customers to boot, one surefire way to keep cash flow healthy is by charging deposits. It’s not common practice in the trades industry but is popular in many other industries, and I for one think we should be following suit.

A deposit is a sum payable as a first installment on the purchase of something or as a pledge for a contract, with the balance being payable later. In this case, the customer pays a sum upfront to confirm the job request, and they pay the remaining amount (the balance) at the end of the job (or in multiple installments for overly large jobs). It’s a fairly straightforward process to manage, especially if you’re using a job management software that integrates with your accounting software.

Here’s a story for you: During Fergus’ early days, when I was still running the plumbing business on a day-to-day basis, I got myself into a bit of a pickle. I’d spent too much money investing in the development of Fergus, the economy was tight and work was slow, and I found myself maxing out the 90-day terms with suppliers. I was on a downward spiral and it wasn’t pretty. If you’ve been there yourself, you’ll know the bitter taste of bile that sits in your stomach – it ain’t good!

Luck was on my side though and we landed a pretty decent drainage job – $80,000 decent. Because of the bad cash flow situation I couldn’t afford to do the job upfront, so I did something I’d never tried before – I invoiced the client for a $40,000 deposit before I started. Which they paid. It was like manna from heaven. Within a week we’d started charging a deposit for every job over $2k. Within the month I’d started going out to site myself at the end of each job to get the balance from the customer, and in just 3 months we’d climbed out of our hole.

Once a customer has paid some cash upfront, there’s less owing at the end and the psychological barrier is broken. If they don’t want to pay a deposit, they generally won’t want to pay at all and you might just find yourself making a lucky escape.

Why not give it a crack? Sure, you might get one or two customers questioning the new policy but before long paying a deposit will be a given, and your cash flow with thank you for it.

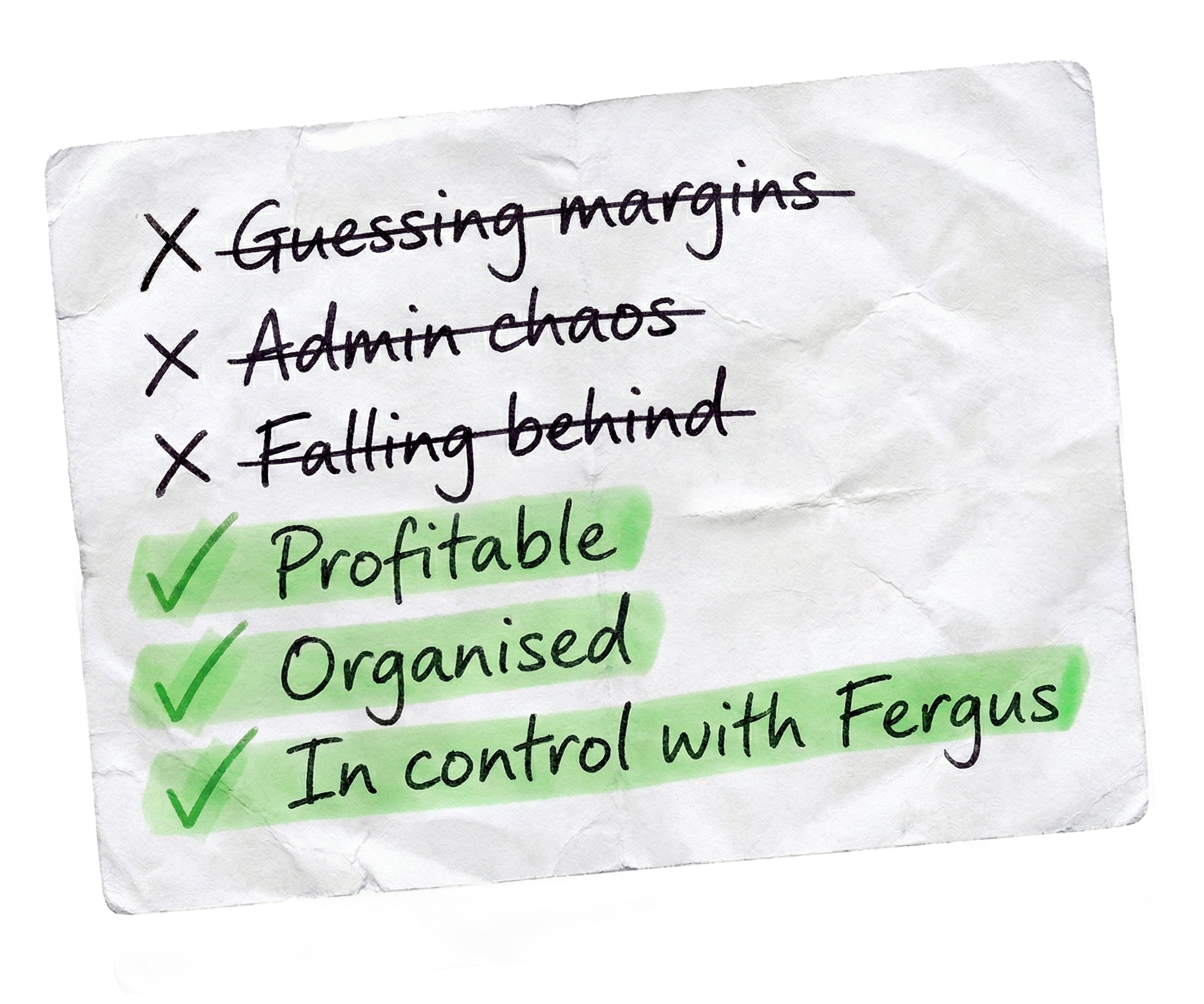

Stop drowning in admin & paperwork. Start focusing on the jobs that make you money.

Our 20,000+ trades businesses have slashed their admin, are getting paid faster, and are finally enjoying their weekends again.