Cashflow refers to the money flowing in and out of a business. As a business owner, watching your revenue grow is greatly rewarding. Having a positive cash flow indicates that your business has money left over after receiving payments on invoices and by paying all expenses incurred. On the other hand, a negative cashflow often indicates that the company is in a dangerous financial position as it may not be able to cover all of the associated running costs.

Monitoring your Cashflow position is crucial to the success of your business, it enables you to meet your financial obligations and to better plan for the future. Unfortunately, many businesses have trouble managing cashflow for a variety of reasons, as it’s usually the last thing on their mind at the end of a busy day.

Utilising a job management system to monitor your cashflow position in real-time allows you to focus on what you need to. In the changing economy, it helps to forecast and build sufficient reserves to cope with seasonal ups and downs.

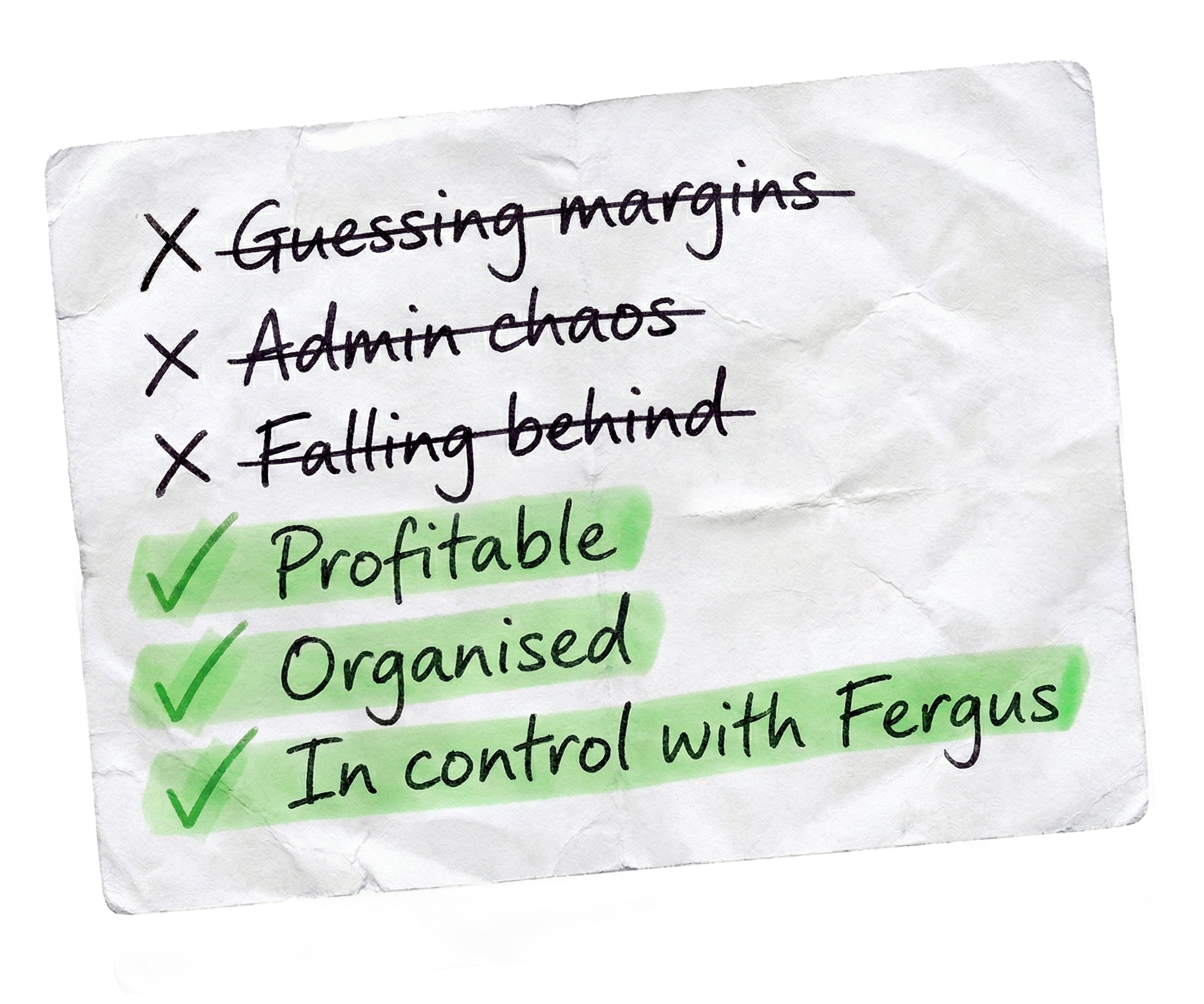

You probably have a lot on your plate. From quoting clients to ordering supplies all the while juggling multiple jobs and time-consuming admin tasks; things can get stressful pretty fast. As a result, a lot of you find that you don’t pay enough attention to your finances as you should. For anyone working in trades, including electricians and builders, you know how difficult it is to stay on top of invoices. It can be daunting looking over your incomings & outgoings and noticing a large number of clients haven’t paid you. But using a system to keep on top of your cashflow will help to ensure your business is staying on track.

Setting a budget makes a huge difference. Establishing a budget for the various costs over the year (such as marketing, supplies, transportation, wages, etc.) can help to reduce on-the-fly decision-making and allows you to see if you have room in your finances to spend money in a certain area or not.

Avoid any nasty surprises by tracking your finances. Knowing where your money is coming from and going to can help you to know where you can cut costs each month or where you may be underquoting without realising. The best way to track your money and stay on top of business finances is with job management software. This software allows you to gain real-time visibility of your business finances at a glance.

Your positive cashflow will really suffer if clients aren’t being timely with payments. Aside from gaining a visual into your overall finances, job management software can encourage faster payments from customers by offering a variety of payment options. A platform such as Fergus can also send automatic email or text alerts to remind customers of their overdue payments, all the while giving them the option to select their preferred way to pay. This helps you to get paid on time, speeding up your cash flow.

Unfortunately, a lot of tradespeople end up with cashflow issues because they’re owed a lot of money from not just clients and customers but also from building construction firms who are lagging on their payments. One way you can save money, time and improve your cashflow is to talk to their suppliers prior to purchasing materials and negotiate their terms. Enquire whether you can get product discounts, return materials that are unused or no longer needed and whether you can get longer payment options.

Cashflow forecasting involves estimating your future sales and expenses. This is the first step towards understanding and better managing your cashflow. The aim is to help you predict your cashflow on a month-to-month basis or for the whole year. Forecasting your cashflow can help to recession-proof your business because it will tell you if you’ll have enough money to run your business or expand it in the next 12 months. This will allow you to make more informed business decisions and help you to overcome any unforeseen events or circumstances beyond your control, for example, the recent COVID-19 pandemic.

In the wake of an impending recession, businesses can be (and have been) exposed to a shortfall of cash due to lack of demand, supply chain disruptions and the inability to forecast cash accurately. All of this can be detrimental for a business, particularly those within the trades and transport industry. You can now see why implementing a cash flow manager or job management software is crucial in navigating unexpected or probable economic collapse along with seasonal market fluctuations.

Cashflow forecasting manually, without help from job management software, often leaves businesses encountering shortcomings and insufficient data to properly predict rapid changes. Here are some other examples of how poor cashflow forecasting can hurt your business:

In essence, tracking cashflow and implementing a cashflow forecast helps to predict your future incomings and outgoings based on your current known costs and past revenue data.

Maintaining a steady cashflow ensures you’ll always have enough money to cover expenses and support the growth of your business. Forecasting cashflow can provide you with a more even footing during times of market downturns or seasonal market changes caused by everything from lack of supply and demand to higher purchasing costs on materials. With the assistance of a job management system, businesses can accurately balance their cashflow, gain insight into important financial data, and deliver more efficient customer service.

Stop drowning in admin & paperwork. Start focusing on the jobs that make you money.

Our 20,000+ trades businesses have slashed their admin, are getting paid faster, and are finally enjoying their weekends again.