Managing your business in a rapidly changing landscape can be a challenge, and maintaining your tax obligations only adds to the list of demands.

In this post, we explain everything you need to know about the Construction Industry Scheme (CIS) and what it could mean for your business.

What is the Construction Industry Scheme (CIS)?

The Construction Industry Scheme (CIS) is a tax deduction scheme that ensures fair tax collection from those engaged in construction work.

The scheme is overseen by HMRC and applies to both contractors and subcontractors involved in construction projects. By understanding how the CIS works, trades contractors can navigate its requirements efficiently and avoid potential pitfalls.

Who is covered by CIS?

Understanding CIS Deductions:

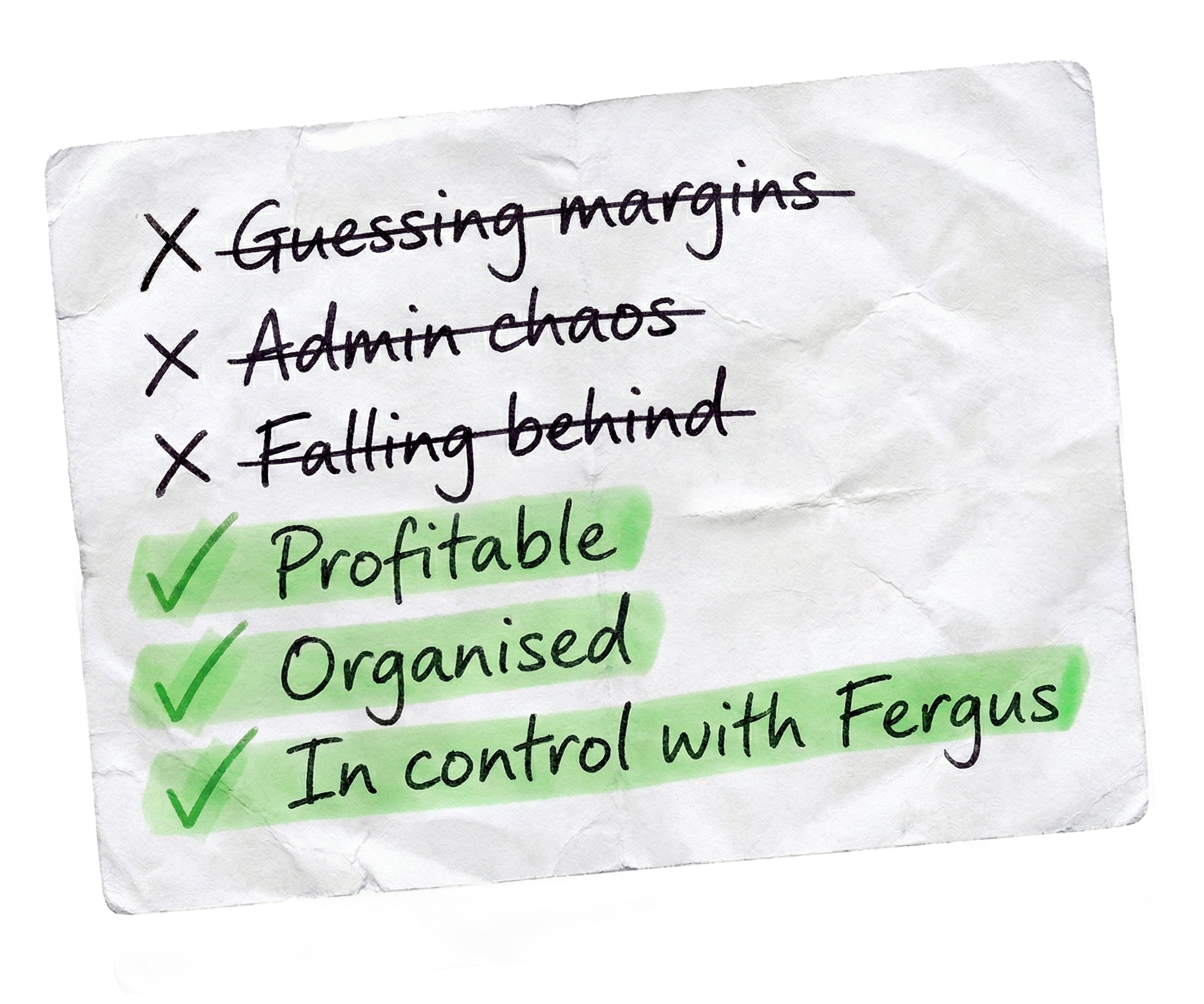

At Fergus, we’re all about keeping things simple. Contractors have the responsibility of deducting money from their subcontractors’ payments and forwarding it to HMRC as advance tax payments.

Standard Rate Deduction:

Subcontractors who are registered with HMRC fall under the standard rate deduction, set at 20%. For example, if you pay a subcontractor £1000 for their exceptional plumbing work, you’ll deduct £200 (20%) and remit it to HMRC.

Higher Rate Deduction:

For subcontractors not registered with HMRC, contractors must apply a higher rate deduction, fixed at 30%. That means for the same £1000 payment, you’ll need to deduct £300 (30%) and ensure timely remittance to the authorities.

Can subcontractors be exempt from paying CIS?

Not all subcontractors have to undergo CIS deductions. Here’s some examples of exemptions:

Gross Payment Status:

Qualified subcontractors can apply for Gross Payment Status, allowing them to receive full payments without any deductions. Keep your tax records clean, meet HMRC criteria, and enjoy the benefits of Gross Payment Status.

Deemed Contractors:

Entities outside the construction industry, such as property developers or government departments, can be deemed contractors. They must register under the CIS and operate similarly to regular contractors.

Expert Tip

With Fergus, you can make managing CIS payments a breeze with Xero integration.

Navigating the Construction Industry Scheme (CIS) is key for trades contractors seeking a seamless construction journey. Our commitment to simplifying this ensures you stay on top of your tax obligations while continuing to save time and make your business profitable.

Stop drowning in admin & paperwork. Start focusing on the jobs that make you money.

Our 20,000+ trades businesses have slashed their admin, are getting paid faster, and are finally enjoying their weekends again.