In this blog post, our colleagues from the accounting and finance sectors share essential tax planning advice for tradies as the financial year approaches. They offer insights on effectively managing stimulus funds, correctly categorizing expenses, and optimising tax deductions to ensure you’re well-prepared for the fiscal year-end.

With all the turmoil going on in the world at the moment it is easy to forget that we have an end of financial year approaching. The usual tax planning we do for our clients would normally have commenced by now, but we have been absorbed in assisting our clients to access the Australian Government stimulus packages, which means our tax planning time is being used to play catch up on our normal lodgement program. Most accountants around the world will be in the same position this year, so you may need to do a little bit of the tax planning yourself.

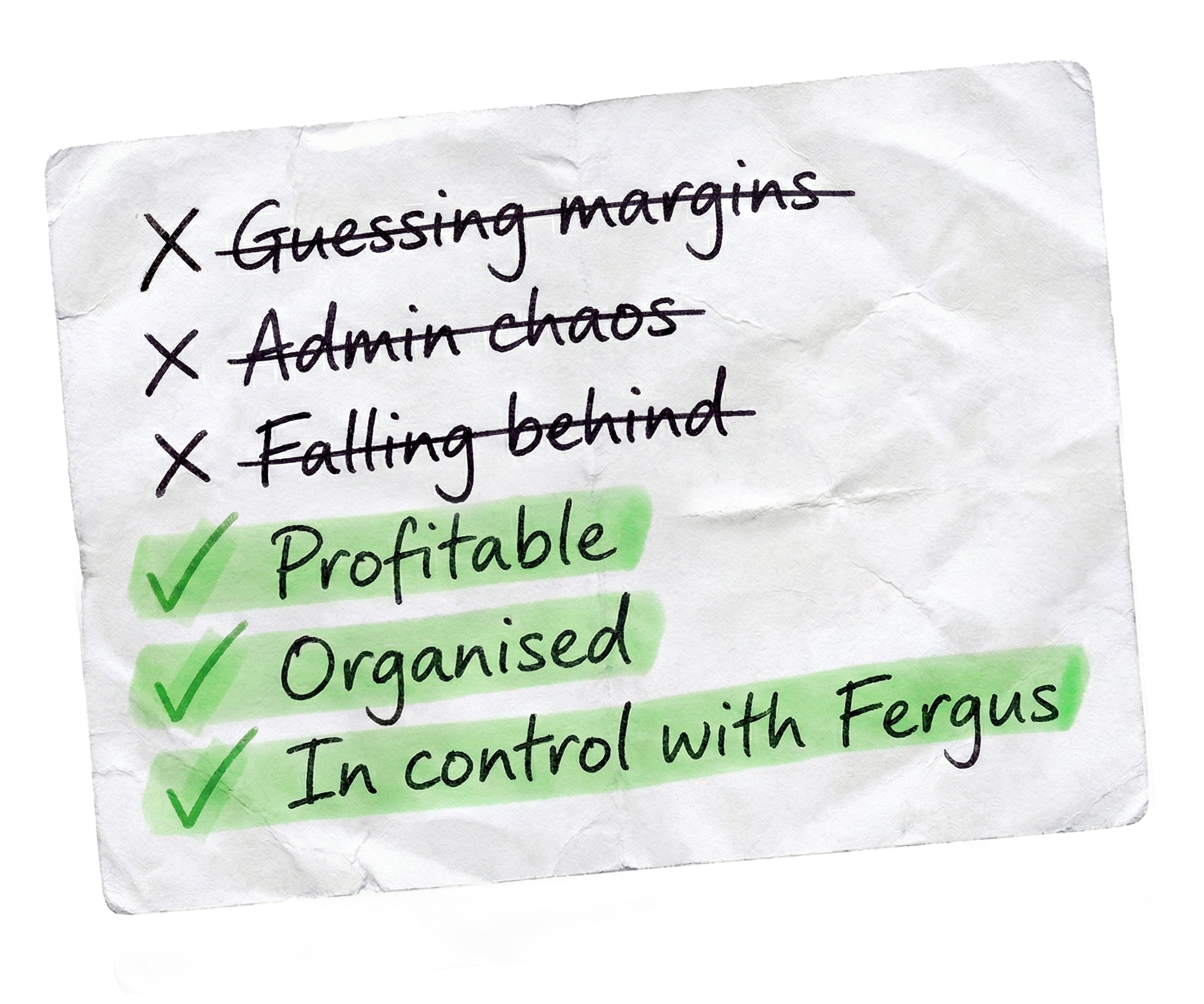

This may sound like the most obvious question ever, but you would be surprised at how many clients, including Tradies, have no idea how they are travelling. If you are using a product like Fergus, it’s likely you are a business owner who does know their figures with confidence. That alone is an advantage you have over your competitors; as good business owners know their numbers, it’s as simple as that.

How often are you looking at the Profit & Loss (P&L) report your system is generating for you (for those using Fergus with Xero, this is your Business Overview report. For everyone else this is your Business Activity report in Fergus)? How confident are you that the figures are correct? This report is a great starting point, so grab your P&L now and work through it with me.

Have a look at your numbers and see if they make sense to you. Your sales should be pretty clear-cut, but the expenses can get a bit muddy. We sometimes categorise things as expenses that should not be there. Not everything that comes out of your bank account is an expense, and not all of it is tax-deductible. Here are a couple of things that may be incorrectly categorised:

Obviously, there are plenty of things to check, but having a fundamental understanding of where you are starting from is important. There is no point spending money to save tax if you are not in a profitable situation.

Superannuation for your staff (or yourself) is only tax deductible if you pay it on time. If you are able to pay the last quarter of superannuation prior to 30 June, you will be able to get that as a tax deduction in the current financial year.

You should always prioritise the payment of your superannuation, as paying it even one day late technically makes it a non-deductible expense.

If you are really behind in superannuation and have the ability to catch up now, the ATO has a Superannuation Guarantee Amnesty until 7 September 2020 for shortfalls between 1 July 1992 and 31 March 2018. Anything declared and paid under the amnesty becomes tax deductible. This could result in a major deduction if you have not been correctly paying superannuation. For more information see this website.

You may also wish to top up your own superannuation if you have a bit of extra money lying around. Superannuation contributions are deductible by up to $25,000 per person for the year. Remember this includes any superannuation you have already paid for yourself during the year (including the superannuation guarantee). Speak to your financial advisor to see if there is a benefit to making an extra contribution for yourself (or other family members) for the year.

Assuming you have a profit and are looking at a tax bill, now is the time to take advantage of the extended Instant Asset Write-Off provisions. Assuming your annual turnover is less than $500 million you can write off any asset up to $150,000 if it was purchased and available for use between 12 March 2020 and 30 June 2020.

What this means is that you do not need to depreciate any new assets under $150,000 purchased during this time, they become an expense straight away.

Here’s an example for you: If you were to buy a new ute for $50,000, your profit will be reduced by $50,000. If you trade out of a company with a tax rate of 27.5%, you would save $13,750 in tax.

This is the most obvious tax saving measure available and we have already seen Tradies looking to purchase new motor vehicles or larger equipment items as a result. With interest rates at an all-time low and many Trades businesses not being as impacted by COVID-19 as other businesses, it may be a good time to look at making a larger capital purchase.

It may sound like a no-brainer, but the best way to get a tax deduction for your expenses is to pay your bills prior to 30 June. Set aside a few hours in your diary on June 25th or 26th to devote to getting everything paid on time. Don’t let the day pass you by. Unless you are an accountant, it is probably just another day for you.

Of course there is more to tax planning than this and we strongly advise you to seek the assistance of your financial advisor this year. It is a strange year with businesses being impacted in different ways. In many cases the overall business performance will be unusual compared to prior years and it is important to know where you stand.

I always stress to my clients that unnecessary spending to get a tax deduction is a silly move. Why would you give someone $100 if all they were going to give you back is $27.50 in return? Yet time and time again businesses buy unnecessary items just to get that tax deduction. You went into business to make a profit, and while saving tax is important, paying some tax should be seen as a badge of honour for running a successful business.

Understanding your position as you approach June 2020 is critical to being able to make good business decisions. You will be glad now, more than ever, that you have invested in good systems, like Fergus, to guide you in the right direction.

Stop drowning in admin & paperwork. Start focusing on the jobs that make you money.

Our 20,000+ trades businesses have slashed their admin, are getting paid faster, and are finally enjoying their weekends again.