Have you heard about the loss leader pricing strategy? Tried it yet? I have and let me tell you, never again!

When I had my trade business I heard about loss leader jobs a few times over the years. I could never work out how the big boys did it, so I thought I’d try it for myself. Get a few bigger projects to just bring in some constant work and keep the team busy… what a disaster!

TLDR: Undercutting your competition may win you the job, but you’ll risk losing your business. Before you start compromising on your quotes, understand your costs and your target gross margin.

For those of you who haven’t heard the term before, a ‘loss leader’ is a product or service offered at a price that’s not profitable, in order to attract new customers or to sell additional products and services to those customers.

It works on the assumption that you’ll then be able to make up for the initial losses through future work and/or potential ‘up-selling’.

I gave it a crack a few years back. It was a big multi-town house development that went on for years. They built the houses in blocks of 6, so the tender was for six at a time.

It seemed straightforward, or so I thought… I worked out my price and submitted it. I missed out by just $2,000. I

Then the tenders went out for the next block of 6.

I figured that if I wanted to win the 2nd bid, I needed to come in under $102K to win. So, I duly went through the quote, cutting margin and hours to get it down to $99k.

We won the job 🎉 (with a 12% gross margin).

And here’s where it all turned to custard.

At this time I didn’t know the rule of gross margin and the need to cover overheads. I was just stoked to have won the job and to be sharing the sandpit with the big boys.

In reality it was impossible to do the job for this price, no matter how hard we tried.

You and I both know, there is a certain amount of hours it takes to do a job and it just can’t be done for less. But not only did we blow out and lose money on labour, but there was also the money held on retention for 12 months.

My actual costs for the job were $117,000, and it was the labour that killed it. So, I failed to cover my costs, I didn’t even cover overheads, and then I had the 5% retention held for 12 months.

Were there any extras? Yes and no… There were a few drainage and water main extras, but these had to be open book on a discounted hourly rate. The head contractors had been doing these jobs for years and they knew how subcontractors like us make money, and they absolutely squeezed us dry down to the last dollar. Our 12% gross margin on the job left no wiggle room for extra jobs.

The whole experience was so emotionally draining, one of the worst things I have experienced. It was a bitter pill to swallow knowing that you’re losing money every day on the job, and there’s no walking away, you still have to finish the job. It’s hard to describe the negative emotions I felt walking on site each day.

From that point onwards, if a job didn’t stack up from day one I didn’t shed a tear if we didn’t get it. I wasn’t prepared to take the risk and hope I’d make enough money from extras if the main job was priced so tight, and looking back it was delusional thinking I could make it work in the first place.

So beware, and take on a loss leader at your own peril. Let my loss be your learning and stick to the formula that works for you. If you’re good at what you do and smart enough to do everything else right, growth will come.

Stop drowning in admin & paperwork. Start focusing on the jobs that make you money.

Our 20,000+ trades businesses have slashed their admin, are getting paid faster, and are finally enjoying their weekends again.

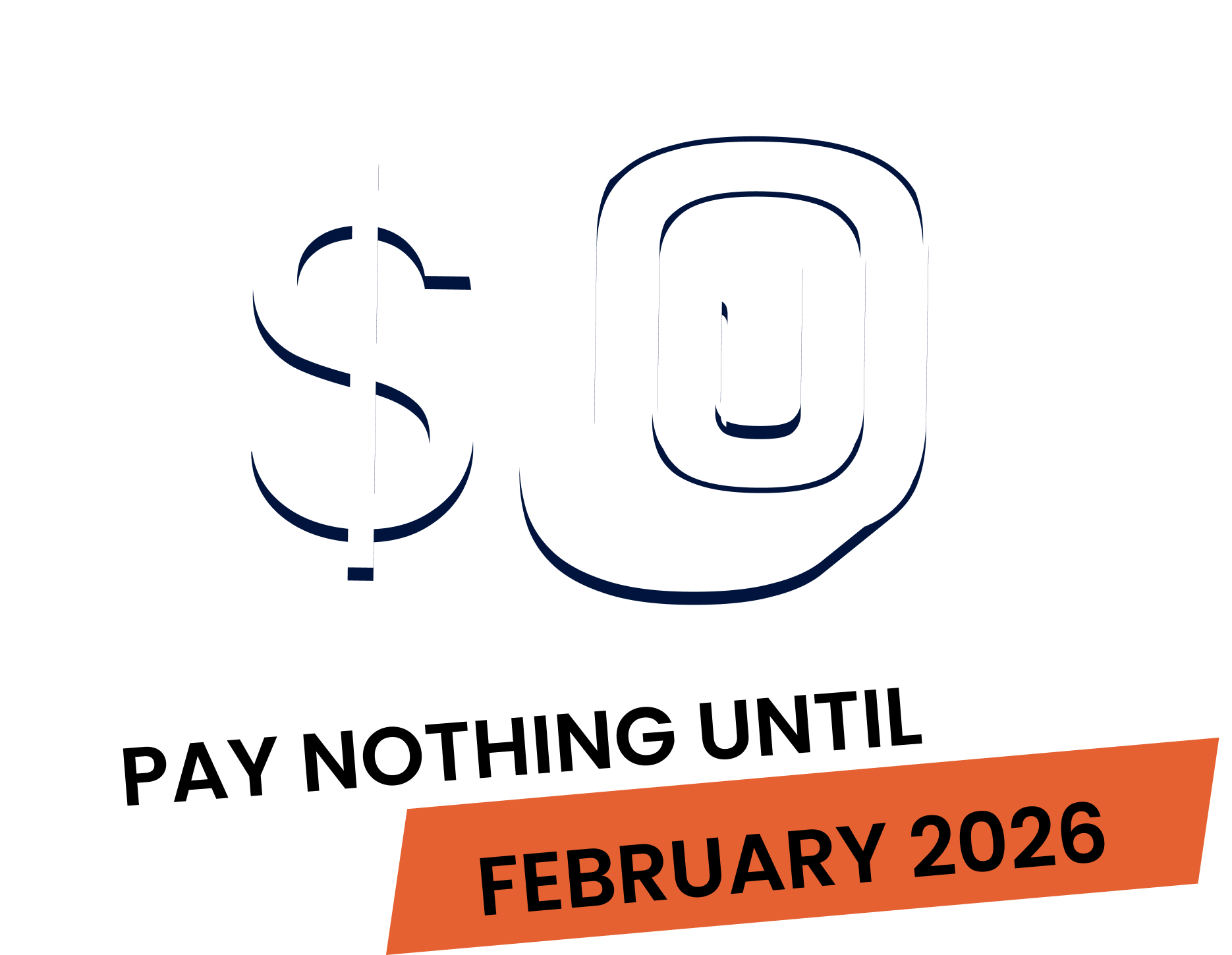

No lock-in contracts.

Free setup & support.