Starting your own trades business as an electrician or plumber can be an exciting venture.

However, to ensure your business is successful, it’s crucial to have a solid business plan.

For those who are new to creating a business plan, think of it as your roadmap, guiding you through the various stages of your business.

Making a business plan helps you set goals, identify potential challenges, and outline strategies to overcome them.

Here’s a step-by-step guide to help you write a business plan that suits your trade.

1. Executive Summary

The executive summary is the first section of your business plan, but it’s often written last.

It provides a brief overview of your business and its goals. Think of it as your elevator pitch.

It should include:

- Business Name: What is your business called?

- Business Location: Where will you operate?

- Services Offered: What services will you provide?

- Mission Statement: What is the purpose of your business?

- Business Goals: What do you hope to achieve in the short and long term?

2. Business Description

In this section, you’ll provide more detailed information about your business. This includes:

- Business Structure: Are you a sole trader, partnership, or limited company?

- Ownership: Who owns the business?

- History: If your business is already established, provide a brief history.

- Market Needs: What gap in the market are you filling?

3. Market Analysis

Understanding your market is crucial for any business.

This section should include:

- Industry Overview: What is the current state of the industry?

- Target Market: Who are your potential customers? Are they homeowners, businesses, or both?

- Market Trends: What are the current trends in the industry?

- Competitive Analysis: Who are your competitors? What are their strengths and weaknesses?

4. Organisation and Management

This section outlines your business’s organisational structure. It should include:

- Organisational Chart: A visual representation of your business’s structure.

- Management Team: Who are the key members of your team? What are their roles and responsibilities?

- Legal Structure: What is your business’s legal structure?

5. Services Offered

Detail the services your business will provide. This section should include:

- Service Description: What services will you offer? Be specific.

- Pricing Strategy: How will you price your services? Consider your costs, competitor pricing, and market demand.

- Unique Selling Proposition (USP): What makes your services stand out from the competition?

6. Marketing and Sales Strategy

Your marketing and sales strategy outlines how you will attract and retain customers. This section should include:

- Marketing Plan: How will you promote your business? Consider online marketing, word-of-mouth, and local advertising.

- Sales Strategy: How will you sell your services? Will you offer discounts, packages, or loyalty programs?

- Customer Retention: How will you keep your customers coming back?

7. Financial Projections

Financial projections are a critical part of your business plan.

They provide a forecast of your business’s financial performance. This section should include:

- Revenue Projections: How much money do you expect to make?

- Expense Projections: What are your expected costs?

- Profit and Loss Statement: A summary of your expected income and expenses.

- Cash Flow Statement: A forecast of your cash inflows and outflows.

- Break-Even Analysis: When do you expect your business to become profitable?

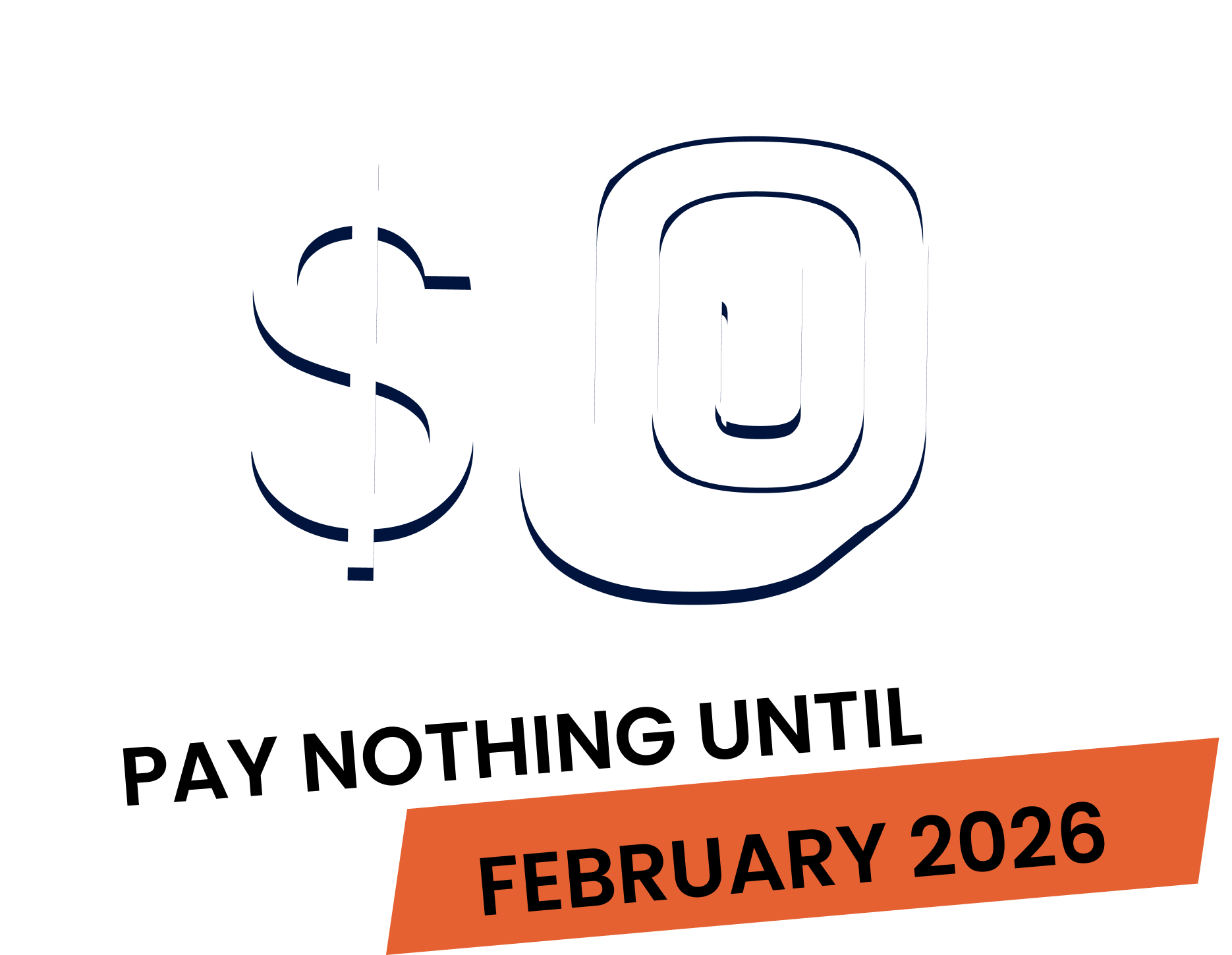

8. Funding Request

If you need funding to start or grow your business, this section is essential. It should include:

- Funding Requirements: How much money do you need?

- Funding Sources: Where will the money come from? Consider loans, investors, or personal savings.

- Use of Funds: How will you use the funds? Be specific.

9. Appendix

The appendix includes any additional information that supports your business plan. This might include:

- Resumes: For you and your management team.

- Permits and Licenses: Any necessary legal documents.

- Market Research: Any additional market research data.

- Contracts: Any contracts with suppliers or customers.

Tips for Writing Your Business Plan

- Be Clear and Concise: Avoid jargon and keep your language simple.

- Be Realistic: Set achievable goals and realistic financial projections.

- Update Regularly: Your business plan should be a living document that you update regularly.

- Seek Feedback: Get feedback from trusted advisors or mentors.

Final Thoughts

Writing a business plan might seem daunting, but it’s a crucial step in setting up your business for success.

It may surprise you how helpful the process can be in getting all of your thoughts down on a document that you can refer back to.

But a well-thought-out business plan is not just a document; it’s a tool that will help you achieve your business goals and grow your business.